MASTER SERVICE AGREEMENTS

Texas Attorneys

A Master Services Agreement (MSA) should outline party responsibilities, party expectations and provide for a Statement of Work (SOW) format for the work to be performed.

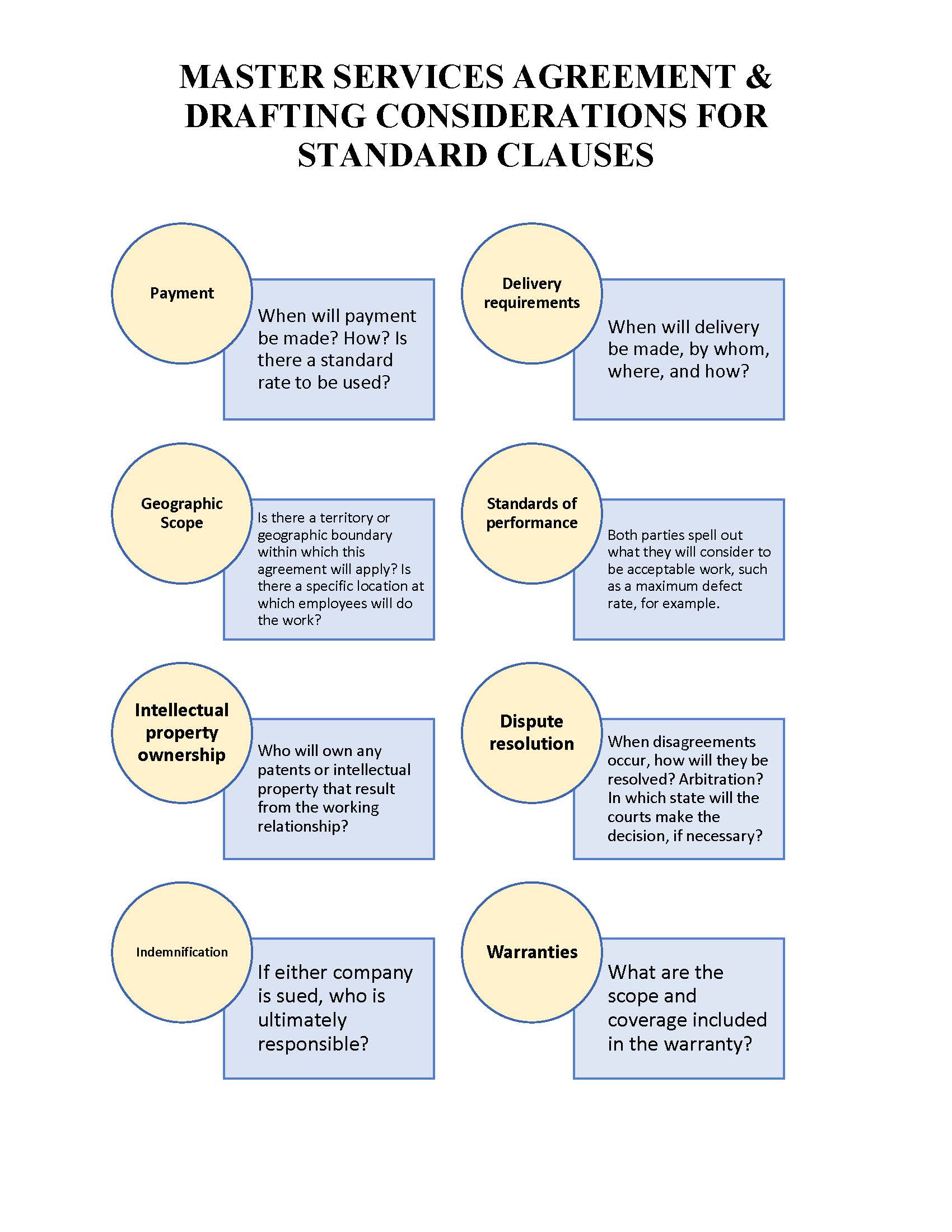

DRAFTING MASTER SERVICE AGREEMENTS

What Is A Master Service Agreement?

A Master Service Agreement (MSA) is a contract and mutual agreement in which the parties involved come to a basic understanding and consensus on the terms accepted for future transactions or agreements. Once an MSA is established, the parties only need to negotiate the specifics of a transaction or agreement, essentially saving time and ensuring that the process is a quick and streamlined one. MSAs are not a guarantee of business, rather just a time-saving tool used to streamline future negotiations.

MSAs are frequent in industry forms, including government and commercial industries in software development, marketing, or product sales and product development. They should summarize the scope of work to be performed, responsibilities, expectations, and requirements of each party. MSAs are unique to the nature of each project, considering various scenarios, favorable and unfavorable to each party, and often suggest guidance for how to resolve them.

Important Considerations For A Master Service Agreement

Common Benefits of a Master Services Agreement

- MSAs set the foundation to future agreements by having terms already set;

- MSAs save time by bypassing the load of negotiating every step in a project or agreement;

- MSAs help prevent misunderstandings, speed up, and simplify future contracts; and

- Businesses with services transactions that have new projects or contracts that may develop quickly should utilize MSAs.

Common disputes and risks associated with a Master Services Agreement involve:

- Employee injury or death;

- Property damage;

- Unauthorized charges;

- Product defects;

- Failure to communicate, meet deadlines, and pay as agreed; and

- Intellectual property disputes such as copyright disputes and other IP ownership issues.

What Is A Statement of Work?

A Statement of Work (SOW) is a document that outlines the terms and conditions of a particular project or service between two or more parties. These parties will prepare an SOW in a format consistent with the Master Services Agreement (MSA) to which that SOW will be governed. The SOW specifies in clear layman terms what the service provider must do for the customer, reducing the chances of miscommunication between the parties after the work commences. You do not put legalese into an SOW. Any legal terms and conditions belong inside the MSA. The SOW should only be used as a vehicle to define the nature of the work performed. In most cases, the MSA should always control the SOW if there is a conflict between the MSA and the SOW.

Master Services Agreement Disputes

An MSA provides a basis upon which two or more parties enter into work engagements, such as a statement of work (SOW) that define the basic overall legal and work performance terms. A firm MSA with a solid SOW allows all parties to feel secure that the work being done is reasonable and the risks minimized if a dispute arises. A solid Master Services Agreement always provides default rules and risk allocations between the contracting parties, reducing unexpected and unanticipated future liability.

Our attorneys at Wilson Legal Group have over 20 years of protecting and defending businesses, ideas, and personal interests in MSA and SOW disputes. Having a good MSA is essential and should be narrowly tailored for each industry and purpose to protect the interest of both parties. We provide advice regarding breaches of MSAs, business litigation disputes, and other contractual drafting assistance, such as the preparation of statements of work (SOWs).

Need any help?

CLIENT MATTERS

5,000+

YEARS OF SERVICE

25+

Award Winning

Recognized in the legal industry as dedicated board-certified lawyers and Rising Stars.

Expert Team

Your project will be handled by legal experts every time. You will have the most experienced attorneys working for you.