GETTING YOUR LIQUOR AND BEER

LICENSE IN TEXAS

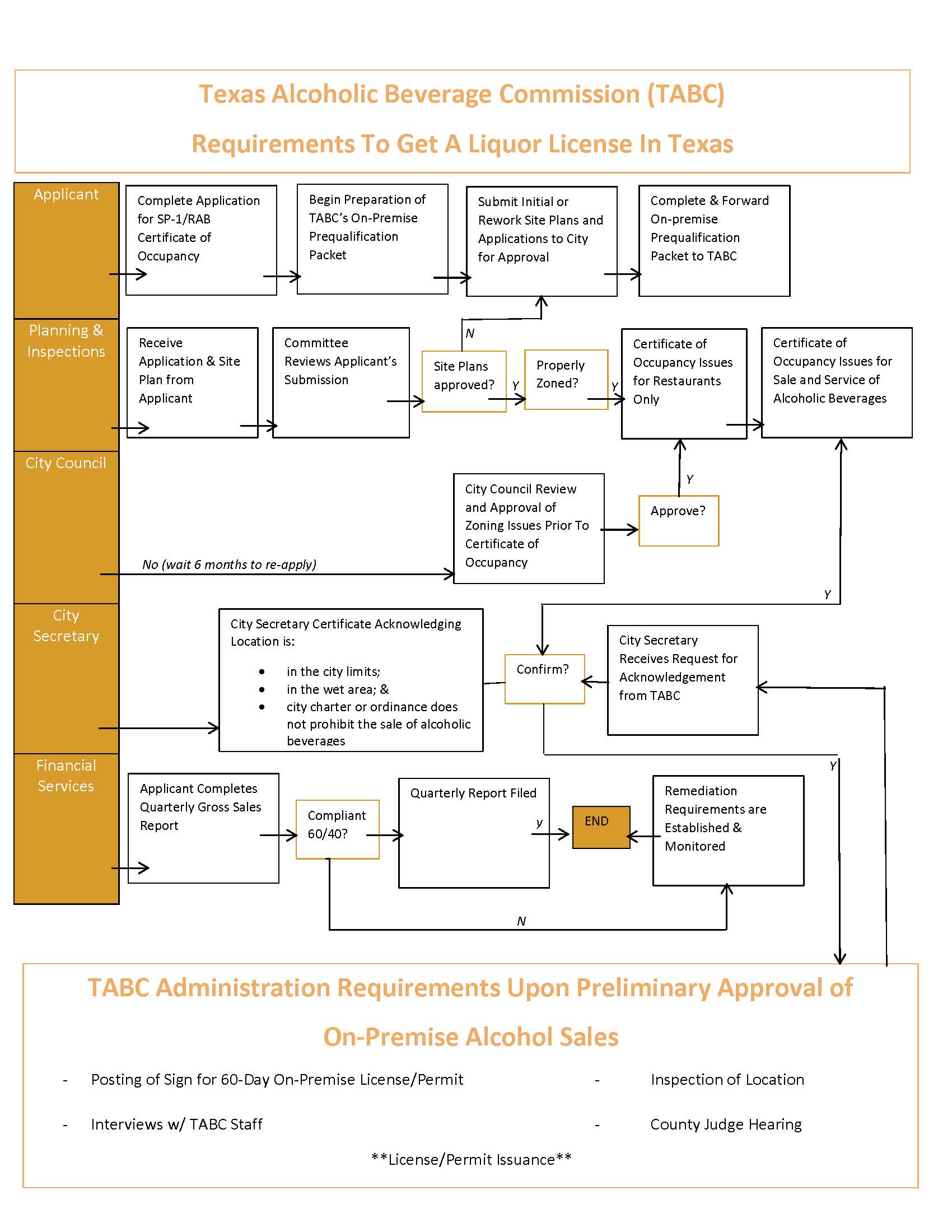

The Texas Alcoholic Beverage Commission (TABC) is a State of Texas agency which regulates alcohol sales, and educates business owners on the sale and service of alcohol.

CHECKLIST FOR APPLYING FOR A LIQUOR LICENSE

Requirements To Get A Wine & Beer Permit in Texas

In order to get your beer and wine permit in the State of Texas, you and your business must fill out an application with the TABC and provide certain verification from a city and/or country clerk that i) your business is within a regulated zone where alcohol sale and/or consumption is permitted and ii) provide verification of the alcohol content contained within the beverages for such sales. All business owners cannot not have any of the following:

- Any felony convictions within the past five years;

- Any violations of state liquor laws within the past two years; or

- Any moral turpitude violations of liquor laws within the past six months.

Our Dallas TABC lawyers can assist you in applying for your liquor and beer license.

For more information on the regulation of alcohol in Texas see our Texas Alcohol Regulation and Facts web page and know your Texas Alcohol Zoning Laws for wet & dry areas.

At

Wilson Whitaker Rynell Attorneys at Law, our liquor license attorneys specialize in navigating the complexities of alcohol licensing for businesses such as bars, restaurants, liquor stores, and other establishments that require a liquor license issued by the Texas Alcoholic Beverage Commission (TABC). It is crucial for business owners involved in the sale of alcohol to have proficient legal representation when dealing with the TABC. Our experienced TABC attorneys in Dallas are dedicated to guiding you from the initial stages of business planning through production and sale, ensuring a smooth licensing process.

Additional TABC License Focus

Types of Alcohol Licenses In The State of Texas

Our Dallas Alcohol Licensing and Permitting attorneys can assist you in selecting the proper alcohol and beverage license for your business. Below are several types of alcohol license permits in Texas. A complete list of these licenses can be found at the Texas Alcoholic Beverage Commission :

- AIRLINE BEVERAGE PERMIT (AB): A corporation can operate a commercial airline to sell or serve alcoholic beverages.

- BREWER'S PERMIT (B): Holder can manufacture malt liquor or ale, and then to sell that ale and malt liquor only to wholesale permit holders.

- MANUFACTURER'S LICENSE (BA): Holder can manufacture beer and sell it to holders of general, local and branch distributor license holders.

- GENERAL DISTRIBUTOR'S LICENSE (BB): Authorizes the sale of sell beer to other distributors, local distributors, private clubs and retailers, etc.

- BRANCH DISTRIBUTOR'S LICENSE (BC): Authorizes a general distributor to expand its distribution business.

- RETAIL DEALER'S ON PREMISE LICENSE (BE): Holder may sell beer for consumption on or off premises in a lawful container to the ultimate consumer but not for resale. Requires adequate seating area for customers.

- RETAIL DEALER'S OFF PREMISE LICENSE (RF): Holder may sell beer in a lawful container direct to the consumer but not for resale and not to be opened or consumed on or near the premises.

- WINE AND BEER RETAILER'S PERMIT (BG): Authorizes sell for consumption on or off the premises where sold but not for resale, beer, ale, malt liquor and wine not more than 14 percent or 17 percent, etc.

- FOOD AND BEVERAGE CERTIFICATE (FB): A Food and Beverage Certificate may be issued to the holder of a Beer Retailer's On-Premise Permit or Wine and Beer Retailer's Permit if food service is the primary business being operated on the licensed premises, etc.

- WINERY PERMIT (G): Authorizes the manufacture, bottle, label and package wine containing not more than 24 percent alcohol by volume, etc.

- IMPORTER'S LICENSE (BI): License authorizes distributor to import beer from outside Texas.

- IMPORTER'S CARRIER'S LICENSE (BJ): Authorizes a distributor with an importer's License to import beer in vehicles owned or leased.

- BREWPUB LICENSE (BP): Authorizes the manufacture, brew, bottle, can, package and label malt liquor, ale, and beer; sell or offer without charge, on the premises of the brewpub, to ultimate consumers for consumption on or off those premises, malt liquor, ale or beer produced by the holder in or from a lawful container, etc.

- WINE AND BEER RETAILER'S OFF-PREMISE PERMIT (BO): Authorizes the sell for off-premises consumption only, but not for resale, wine, beer, and malt liquors containing alcohol in excess of one-half of one percent (1/2 of 1%) by volume and not more than 14 percent or 17 percent of alcohol by volume.

- NONRESIDENT MANUFACTURER'S LICENSE (BS): Authorizes the holder to have beer received in Texas through importer's License.

- CATERER'S PERMIT (CB): Authorizes holder to sell mixed beverages on a temporary basis at a place other than the premises for which the original permit is issued.

- DISTILLER'S AND RECTIFIER'S PERMIT (D): Authorizes the manufacturing of distilled spirits and rectify, purify, and refine distilled spirits, mix liquor, bottle and package finished products and sell to wholesalers and qualified individuals outside this state, etc.

CLIENT MATTERS

5,000+

YEARS OF SERVICE

25+

Award Winning

Recognized in the legal industry as dedicated board-certified lawyers and Rising Stars.

Expert Team

Your project will be handled by legal experts every time. You will have the most experienced attorneys working for you.

Quality Representation