Creating an Intellectual Property Holding Company

Whether you’re a seasoned business owner or a budding entrepreneur, understanding the importance of IP assets and how to protect those valuable IP assets is crucial to maximizing your business IP portfolio. An IP holding company can be a vehicle to exploit valuable IP while minimizing its exposure to operational liabilities. This separation allows you to protect your IP from both litigants and creditors in the event your operating company is sued.

What is an Intellectual Property Holding Company?

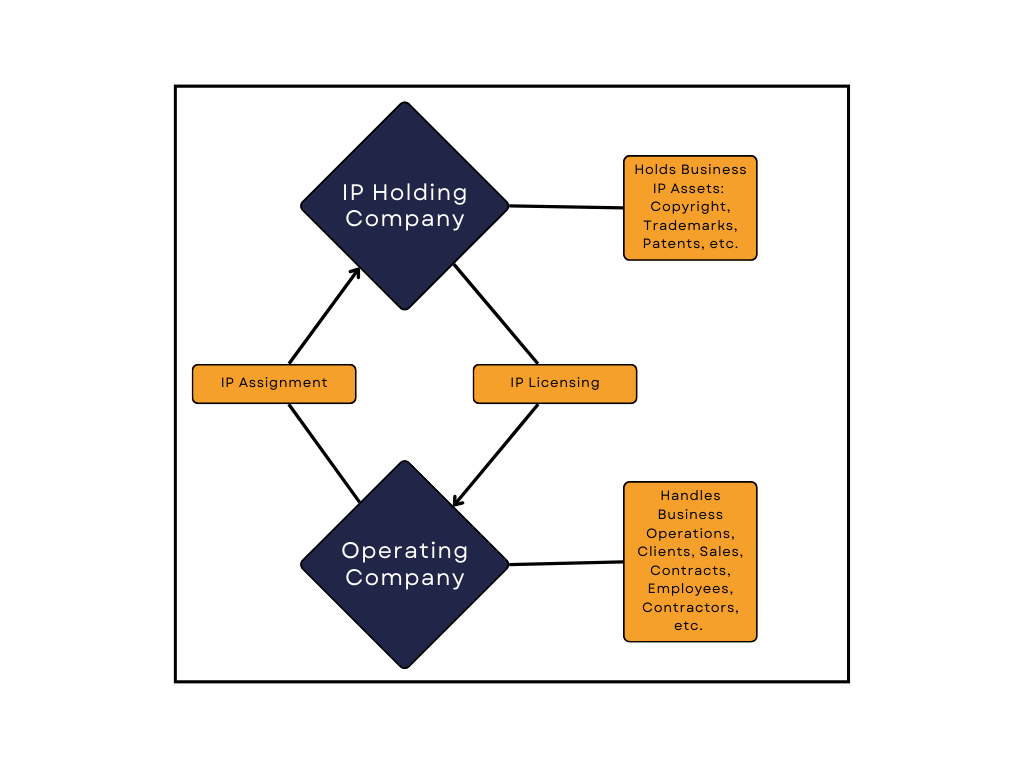

Simply stated, an intellectual Property Holding Company is a business entity specifically created to own and manage a company’s IP assets. These assets can include trademarks, patents, copyrights, and trade secrets. By transferring IP assets to a holding company, businesses often can protect these valuable resources from unknown business risks and leverage them more effectively.

Imagine you own a business called “Empire National, Inc.” and have a valuable trademark associated with it called "Empire Galore Grills." Additionally, Empire National has developed a plethora of copyrighted materials to market products and services to the general public. To enhance protection, Empire National decides to form a separate IP holding company named “Empire IP Holdings, Inc.” to manage these trademarks and copyrights. By establishing Empire IP Holdings, one can license those IP trademarks and copyrights back to Empire National, or to any third party, for the payment of a royalty fee. Such an arrangement not only streamlines IP management but also creates an additional revenue stream. Even if there is additional work to be done in managing the accounting of Empire National and Empire IP Holdings, the benefits of separating the operating entity from the IP ownership far outweigh the additional work and efforts. This separation significantly reduces the risk of losing valuable IP assets if litigation ensues against Empire National.

Why Create an IP Holding Company?

There are a number of benefits to consider when deciding whether forming an IP Holding Company is right for you specific circumstances. Most notably, an IP holding company will allow you to:

- Be Protected From Litigation:

One of the primary reasons to create an IP holding company is to protect your assets from lawsuits. By separating your IP from your operating business, you shield these assets from potential liabilities.

- Have Potential Tax Benefits:

Depending on your jurisdiction and IRS rules, there may be significant tax advantages in separating IP income and business income of the operating entity. For example, royalties paid to the holding company can sometimes be taxed at a lower rate.

- Control Asset Management and Licensing:

An IP holding company can manage and license the IP assets more effectively, including licensing IP brands to multiple companies. This can streamline operations, create multiple channels for growth, and overall enhance revenue generation through licensing agreements.

- Enhance Valuation and Investment:

Holding IP assets in a single dedicated company can make it easier to manage, protect, and value these assets. An IP holding company is often attractive to investors as the IP is clearly assessable and known to potential investors or buyers.

Setting Up an IP Holding Company in Texas

Intellectual property (IP) is a crucial asset for your business, and as a business owner, you owe it to yourself and your stakeholders to effectively manage and protect these valuable resources. At Wilson Whitaker Rynell, we understand the importance of safeguarding these IP assets to ensure your business's continued success and growth. Here’s how we can help:

- Comprehensive IP Asset Evaluation

Our law firm can assist with a thorough evaluation of your IP assets, including trademarks, patents, copyrights, and trade secrets. This helps both us and you determine the best strategy for transferring and managing these assets.

- Legal Structure and Jurisdiction Advice

Choosing the right legal structure and jurisdiction for your IP holding company is crucial. Our IP legal experts provide personalized advice to ensure you select the most beneficial options for your business needs.

- Drafting and Executing Transfer Agreements

Our business lawyers draft and execute all necessary transfer agreements to seamlessly move your IP assets to the new holding company, including registering those transfer agreements and assignments with the patent, trademark, and copyright offices.

- Licensing Agreements

Our attorneys prepare well-drafted licensing agreements between your IP holding company and operating business, as well as with any third parties licensed entities. These agreements clearly and succinctly outline the terms of use, licensing fees, and royalty payments to be received by the holding company.

- Ongoing Compliance and Management

Maintaining compliance with all legal and regulatory requirements is essential. Our business attorneys provide ongoing support to ensure your IP holding company remains compliant, legally relevant and effectively managed.

Texas IP Holding Business Law Attorneys

Protecting your IP assets is an investment in your business’s future. Contact Wilson Whitaker Rynell today to learn more about setting up an IP holding company and how we can help secure your valuable intellectual property and lower your risk of losing IP to litigation or creditors.

Wilson Legal Group assists clients throughout Dallas, Houston, Austin, and the rest of Texas in helping businesses create IP Holding Companies. We have successfully helped clients in Plano, Frisco, Addison, Richardson, Fort Worth, Irving, Carrollton, Taylor, Dallas County, Denton County, Collin County protect their intellectual property.

Contact Us or Call 972-248-8080 for a Free Consultation!

What is an IP Holding Company?

IP, or intellectual property, holding companies are LLCs or corporations specifically designed to hold intellectual property assets. These entities provide enhanced privacy, asset protection, and tax minimization benefits.

How do I setup an IP Holding Company?

An IP holding company is established just like any other general-purpose company. You choose a state, such as Texas, Delaware, or Wyoming, file your Articles of Organization, choose a registered agent, and draft an operating agreement. You must then create licensing and transfer agreements between the operating entity and the holding company and, if necessary, any third-party licensees.

What is the purpose of a IP Holding Company?

An IP holding company is designed to manage and protect a business's intellectual property assets. It provides enhanced privacy and asset protection by separating IP assets from the operating entity. This separation shields the IP from operational liabilities and potential litigation. Additionally, an IP holding company can offer tax benefits by optimizing how IP income is taxed.

How do I manage licensing with an IP Holding Company?

Licensing intellectual property from an IP holding company involves a structured process to ensure clarity and legal protection for both the operating entity and the holding company. You must first draft a comprehensive licensing agreement that outlines the terms and conditions, including the scope, duration, fees, and any usage restrictions. This ensures that the IP rights are properly transferred to the holding company through legal assignments and related transfer agreements. Depending on the jurisdiction, or if it’s a patent, trademark, or copyright, you may need to register the IP assignment or license agreement with the appropriate governmental or IP office.

Have an idea for a blog? Click and request a blog and we will let you know when we post it!