Understanding Texas Mechanics Liens:

A Vital Tool for Contractors

A materialman's lien, also known as a mechanic's lien, is a powerful legal tool that provides security to contractors, subcontractors, and suppliers in Texas. When these service providers have delivered labor or materials to a construction project and have not been paid, a mechanics lien ensures they can secure payment. This lien grants them a security interest in the property, allowing them to force a foreclosure to recover their dues if necessary. Let's explore the intricacies of Texas mechanics liens, the detailed process of filing them, and how initiating foreclosure can serve as a remedy for non-payment.

How Does A Mechanics Lien Work?

Who Can File a Mechanic's Lien?

Mechanics liens enable contractors and suppliers to place a claim against a property they have worked on, especially when facing payment issues. This process typically involves filing a Notice of Lien with the county clerk's office in the county where the property is located. By doing so, contractors and suppliers secure their right to receive payment for their labor and materials. Typically, those eligible to file a mechanics lien include:

- General contractors

- Subcontractors

- Material suppliers

- Equipment lessors

- Laborers

The eligibility criteria may vary slightly depending on the jurisdiction, but the primary objective remains the same: ensuring that those who have contributed to the improvement of a property are paid for their services and materials.

See CHAPTER 53. MECHANIC'S, CONTRACTOR'S, OR MATERIALMAN'S LIEN

How Do I Secure a Mechanic's Lien against Property?

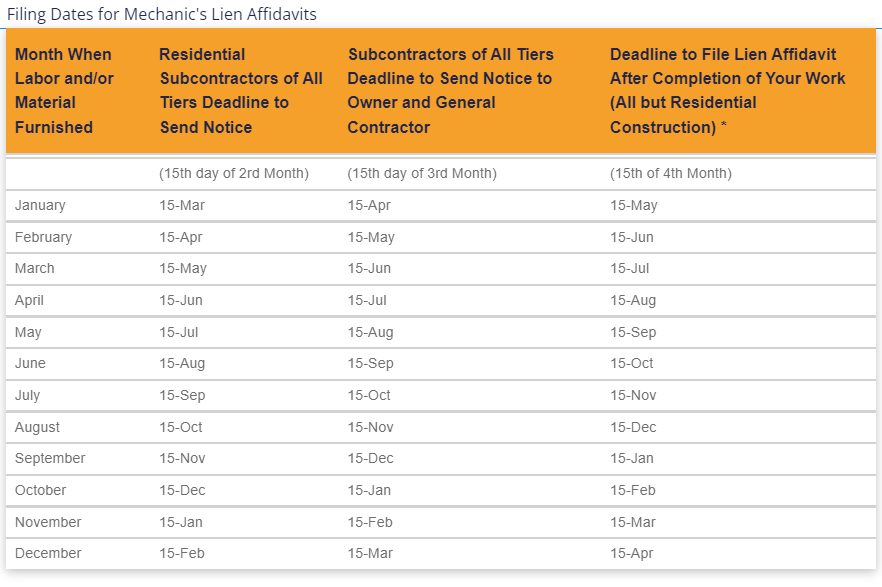

For original contractors, no preliminary notice is required. However, subcontractors and suppliers must provide notice to both the property owner and the original contractor. Specifically, for residential projects, they must send a notice of unpaid balance to the property owner and the original contractor by the 15th day of the fourth month following each month in which work was performed or materials were delivered. For subcontractors, the time frame is the 15th day of the third month, as shown below:

Example 1: Original Contractor on a Residential Property

If a subcontractor completes work on a residential property in the month of January, they must send a notice of unpaid balance to the property owner and the original contractor by March 15th. This ensures that the notice is sent by the 15th day of the third month following the month in which the work was performed.

Example 2: Subcontractor on a Residential Property

If a supplier delivers materials to a construction site in the month of February, they must send a notice of unpaid balance to the property owner and the original contractor by April 15th. This follows the requirement to notify by the 15th day of the second month after the delivery of materials.

Filing the Mechanic's Lien Affidavit

In Texas, the lien notice must include the following and be filed in the county clerk’s office in the county where the property is located:

- Name and address of the claimant.

- Name and address of the property owner.

- A general statement of the work performed or materials supplied.

- The amount claimed.

- The legal description of the property.

- The date the work was completed or the materials were furnished.

- A statement identifying the original contractor.

Deadlines for Filing the Mechanic's Lien Affidavit

As stated above, in Texas, the deadlines for filing a mechanics lien affidavit are crucial: for original contractors, the affidavit must be filed by the 15th day of the fourth month after the month in which the contract was completed, terminated, or abandoned; for subcontractors and suppliers, it must be filed by the 15th day of the third month after the last month in which labor was performed or materials were supplied.

- Original Contractors: Must file the lien affidavit by the 15th day of the fourth month following the month in which the work was completed or the materials were supplied.

- Subcontractors and Suppliers: Must file the lien affidavit by the 15th day of the third month following the month in which the work was completed or the materials were supplied.

Filing Dates for Mechanic's Lien Affidavits

* For residential construction projects, no later than the 15th day of the third month after the month in which the original contractor's work was completed, terminated, or abandoned. For subcontractors on a residential construction project, no later than the 15th day of the second month after the month in which the original contractor's work was completed, terminated, or abandoned

Where to File the Mechanic's Lien Affidavit

You must file the lien affidavit with the county clerk’s office in the county where the property subject to the lien is located. This step is crucial to ensure that your lien is properly recorded and enforceable. When filing, ensure that all details are accurate and complete, including the property description, the amount owed, and the date of the last labor or materials provided. Once filed, it is also advisable to send a copy of the lien affidavit to the property owner and any other relevant parties to notify them of the lien's existence and your claim.

Notice of Filing of Mechanic's Lien

After filing the lien affidavit, you must send a copy of the filed lien affidavit to the property owner and the original contractor (if applicable) within five days of filing. This notification ensures that all parties are aware of the lien and its claims. The copy should include all pertinent information, such as the date of filing, the amount claimed, and the property details. Sending this notice promptly is essential for maintaining the validity of your lien and protecting your rights under Texas law. It's recommended to use certified mail with return receipt requested to have proof of delivery.

Special Considerations

Homestead Properties:

- Additional requirements apply if the property is a homestead. A written contract signed by the owner and the spouse (if applicable) and filed with the county clerk before any work begins is necessary.

Retainage Notices:

- For retainage claims, provide a notice of retainage agreement to the property owner and the original contractor within the required timeframes.

Understanding Shortened Lien Filing Deadlines for Unpaid Materials and Labor in Texas:

In Texas, specific lien filing deadlines apply when claiming unpaid materials or labor against the statutory reserved fund. For liens unrelated to contractual retainage, the claimant must file their lien affidavit within 30 days after the earliest occurrence of completion, termination, or abandonment of the original contract. This deadline can be earlier than the standard 15th day of the fourth-month deadline. To comply with Texas lien laws and secure the right to payment for services or materials provided, all claimants should adjust their pre-lien notice deadlines to align with or precede this shortened lien filing deadline. This proactive measure ensures compliance and protects the claimant’s right to payment.

What is the Texas Statute of Limitations for a Mechanics Lien?

For residential projects in Texas, you must take action to enforce a mechanics lien within the later of either: a) one year after the last date the lien could be filed, or b) one year after the project's termination, completion, or abandonment.

Shortened Lien Filing Deadlines for Unpaid Materials and/or Labor Against the Statutory Reserved Fund in Texas

To comply with Texas lien laws, claimants must file their lien affidavit within 30 days after the earliest occurrence of the completion, termination, or abandonment of the original contract, except for liens related to Contractual Retainage. This filing deadline may precede the standard 15th day of the fourth-month deadline. To ensure compliance, all claimants should adjust their pre-lien notice deadlines to be sent before or at the same time as this shortened lien filing deadline. This proactive approach helps secure the right to payment for services rendered or materials supplied

Different Deadlines for Contractual Retainage Claims in Texas

In Texas, notice must be sent to the owner and general contractor by the earlier of: (a) the 30th day after the claimant's retainage agreement is completed, terminated, or abandoned; or (b) the 30th day after the original contract is terminated or abandoned. For subcontractors, the lien affidavit must be filed by the earliest of: (a) the 30th day after the earliest of completion, termination, or abandonment of the original contract; or (b) the 15th day of the third month after the month in which the original contract was completed, terminated, or abandoned. General contractors must file the lien affidavit by the 15th day of the fourth month after the last day of the month in which the original contract was terminated, completed, or abandoned. This approach aids in compliance with Texas lien laws and secures the right to payment for services or materials provided.

Perfecting a Mechanic's Lien for Specially Fabricated Items

To perfect a claim for delivered or undelivered specially fabricated materials in Texas, compliance with the dates outlined in the chart above is essential. Notice deadlines and lien recording deadlines should be calculated based on the month the claimant was originally required to deliver the specially fabricated materials, regardless of actual delivery. This approach ensures the protection of your lien rights for both delivered and undelivered materials

Specially Fabricated Items Compliance with the dates set forth in the chart above is sufficient to perfect a claim for delivered or undelivered materials, so long as the calculation of the notice deadlines and the lien recording deadlines are calculated from the month the claimant would normally have been required to deliver the specially fabricated materials (even if they were not actually delivered).

The Importance of Compliance With Chapter 53 of the Mechanic's, Contractor's, or Materialman's Lien Statute

Compliance with Chapter 53 of the Texas Property Code is essential for contractors, subcontractors, and suppliers to secure their payment rights for labor and materials provided. Proper adherence to these lien laws ensures that lienholders maintain their right to payment, protecting them from financial loss.

Key reasons for compliance include:

- Securing Payment Rights: Following Chapter 53 requirements protects the right to payment, which is critical for financial stability in construction projects.

- Establishing Priority: Properly filed liens gain priority over later claims, ensuring payment before other creditors in property sales or foreclosures.

- Legal Recourse: Compliance allows lienholders to enforce payment through foreclosure if necessary, providing a legal pathway to recover owed funds.

- Preventing Financial Loss: Non-compliance can void lien rights, leading to significant financial losses for services rendered.

- Professional Reputation: Adherence to lien laws demonstrates professionalism and reliability, enhancing trust with clients and partners.

- Minimizing Disputes: Clear compliance reduces misunderstandings and conflicts over payment and lien rights.

- Meeting Deadlines: Chapter 53 specifies deadlines for filing notices and affidavits. Missing these can nullify lien rights, making timely compliance crucial.

- Comprehensive Coverage: The statute covers claims for labor, materials, specially fabricated items, and contractual retainage, ensuring broad protection.

In summary, complying with Chapter 53 is vital for legal protection, securing payment, and maintaining a professional reputation. It ensures due process and reduces financial risks in the construction industry.

HIRE EXPERT MECHANICS LIENS LAWYERS IN DALLAS-FORT WORTH FOR UNDERSTANDING AND FILING IN TEXAS

Texas lien claim laws are complex, and this legal blog serves only as a guide and not a substitute for hiring a lawyer for advice. For personalized legal assistance with your Texas mechanic's liens, please Contact Us or call 972-248-8080 to speak with a lawyer.

For more information, visit Wilson Legal Group P.C.

Download a PDF copy of Understanding Texas Mechanics Liens.

Have an idea for a blog? Click and request a blog and we will let you know when we post it!