Essential Asset Protection Strategies for Sole Proprietors and Single-Member LLCs

As a business owner, you want to protect your personal assets for retirement and personal living. Protecting those personal assets is essential to ensuring your financial security and long-term success in life. Whether you operate as a sole proprietor or a single-member LLC, understanding the differences in how liability affects what you do is crucial to asset protection. This blog provides insights into the strategies you can implement to safeguard your personal and business assets now and in the future.

Personal Liability in Sole Proprietorships: Mitigating Risks to Protect Your Assets

A sole proprietorship is the simplest form of business ownership, but it comes with significant risks for the uninformed. In a sole proprietorship, the owner and the business are legally indistinguishable and, for all practical purposes, seen as one person. This joinder of liability exposes you to personal liability for all business debts and obligations of the sole proprietorship, meaning that in the event of a lawsuit, your personal assets, like your investment home, non-401K or Roth savings, and your tools of the trade, are vulnerable to being attached or liquidated in a lawsuit.

Strategies to Safeguard Your Assets In A Sole Proprietorship:

- Obtain Adequate Insurance:

We recommend securing comprehensive business insurance to limit your financial exposure to third parties. Coverage should include general liability, professional liability, and property insurance. This not only helps cover legal costs and potential judgments but also significantly reduces the risk to your personal assets.

- Separate Personal and Business Finances:

While not legally required in a sole proprietorship, separating your personal and business finances can enhance financial management and provide a clearer view of your business’s financial standing versus your personal finances. This separation helps in maintaining clear financial records and can be advantageous during tax audits, tax reviews, business audits, and financial reviews.

- Use Contracts Wisely:

Crafting clear and detailed contracts is essential to limiting your exposure to client-related damages. These contracts should accurately define the terms, responsibilities, and liabilities of all parties involved. We recommend including clear warranties, return/exchange policies, and appropriate indemnity clauses, as these require the other party to compensate you for any losses or damages that may occur, further protecting your financial interests

By implementing these strategies, sole proprietors can mitigate the risks associated with personal liability, thereby protecting both personal and business assets. Be proactive by having all your customers sign contracts; this approach not only enhances legal protection for your assets but also fosters a stable foundation for business growth.

Single-Member LLC: Enhanced Protection

A single-member LLC provides a significant advantage in asset protection over a sole proprietorship by creating a legal separation between your personal and business assets. Here's why choosing an LLC might be the right decision for your business:

Limited Liability Protection For LLC

As an LLC owner (member), your personal assets are generally protected from business debts and liabilities. This is one of the most significant advantages of forming a Limited Liability Company (LLC). In the event that your business faces financial difficulties or legal challenges, creditors can pursue the assets owned by the LLC, but not your personal assets, such as your home, personal bank accounts, or other personal property.

How To Maintain the LLC’s Limited Liability Protection Shield

To ensure your single-member LLC continues to protect your personal assets, it’s essential to follow certain practices:

Adhere to Corporate Formalities:

- Even as a single-member LLC, it’s crucial to maintain corporate formalities. This includes:

- Holding Regular Meetings: Schedule and document meetings, even if only with yourself.

- Keeping Detailed Records: Maintain meticulous records of financial transactions and meeting minutes.

- Timely Filing: File required annual reports and fees with the Texas Secretary of State on time.

- Avoid Personal Guarantees:

Where possible, avoid personally guaranteeing business debts or obligations. This keeps your personal assets insulated from business liabilities. Always sign contracts and other legal documents in the name of the LLC, not your personal name. This practice makes it clear that the LLC, not you personally, is responsible for the obligations. For example, when you sign an agreement for your LLC, your signature should denote your title: "John Doe, President." Putting your title reinforces the separation between you and your LLC, but simply putting your name without your company title may imply personal liability.

- Properly Capitalize the LLC:

Ensure the LLC has sufficient capital to operate and cover its liabilities. Underfunded LLCs are more likely to face veil-piercing claims. Courts can sometimes "pierce the corporate veil" if they determine that the LLC was not operated as a separate entity. This can happen if you commingle personal and business funds, fail to follow LLC formalities, or commit fraud or illegal acts. In such cases, you could be held personally liable for business debts. Further, obtain adequate insurance coverage for your LLC to protect against potential liabilities. This includes general liability insurance, professional liability insurance, and any other relevant policies for your industry

- Conduct Business Ethically and Legally:

Adhere to ethical and legal standards in all business dealings to avoid accusations of fraud or illegal activity, which can lead to personal liability. Keep accurate and up-to-date financial records for your LLC. This includes tracking all income, expenses, assets, and liabilities. As for financial statements, regularly prepare and review them to monitor the setup and financial health of your LLC. You need to have a good lawyer and accountant watching what you do and helping guide you when and where necessary.

- Comply With State and Local Laws

Obtaining and maintaining all necessary local and state business licenses and permits required for your LLC’s operations is important to remain legally viable. Compliance with local regulations not only helps preserve your LLC’s good standing but also ensures that your business can operate without legal interruptions. Fines, penalties, and potential legal issues are all evidence that your company is being run inappropriately.

Why a Single-Member LLC is a Smart Choice

Switching from a sole proprietorship to a single-member LLC (Limited Liability Company) offers substantial benefits, making it a smart choice for many entrepreneurs. Besides liability protection (already discussed above), there are several other key advantages to operating as an LLC:

- Tax Advantages

Pass-Through Taxation: A single-member LLC is typically treated as a disregarded entity for tax purposes, meaning the business income is reported on the owner's personal tax return, avoiding the double taxation faced by corporations. Alternatively, the LLC can elect to be taxed as an S-corporation, which can offer additional tax benefits under certain circumstances.

- Increased Credibility

Professional Image: Forming an LLC can enhance your business's credibility and professionalism. Customers, suppliers, and partners often perceive an LLC as a more established and trustworthy entity compared to a sole proprietorship.

- Simplified Management

Simple Organizational Structure: A single-member LLC allows for straightforward management without the need for complex corporate structures. You retain complete control over decision-making and business operations.

- Scalability

Attracting Investors and Financing: An LLC structure can make it easier to attract investors and secure financing. Investors are often more comfortable investing in a business structure that limits their liability. Additionally, banks and financial institutions might view an LLC more favorably when considering loan applications.

- Perpetual Existence

Continuity of Business: Unlike a sole proprietorship, which dissolves upon the owner’s death or decision to stop the business, an LLC can continue to exist even if the owner passes away or exits the business. This continuity can be crucial for long-term planning and stability.

- Customizable Ownership Structure

Flexibility in Ownership: While starting as a single-member LLC, the structure allows for easy addition of new members (owners) without significantly altering the business's legal structure. This flexibility is beneficial if you plan to expand your business or bring in partners in the future.

- Privacy Protection

Anonymity: In some states, LLCs offer the option to remain anonymous, helping to protect your personal privacy. This is particularly advantageous for individuals who prefer to keep their personal information separate from their business activities.

- Legal Recognition

State and Federal Recognition: An LLC is a recognized legal entity in all states, providing a consistent legal framework across state lines. This recognition can simplify interstate business activities and expansion plans.

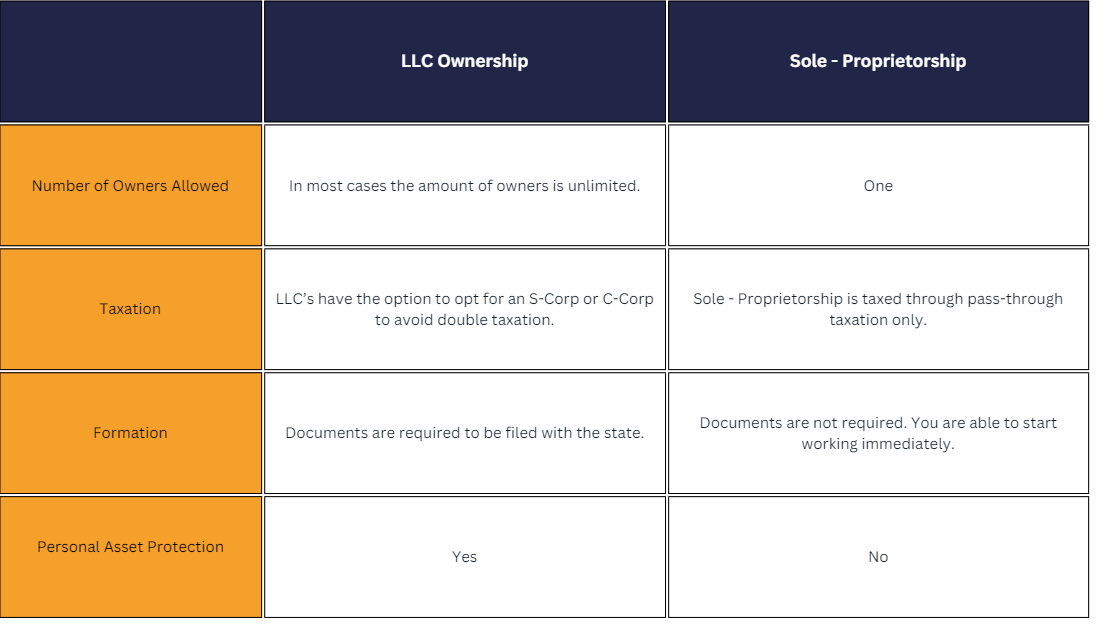

Comparing a Sole Proprietorship to a LLC

Protecting LLCs and Sole Proprietorships | Wilson Legal Group

At Wilson Legal Group, our business attorneys understand the challenges and opportunities that come with managing, operating and maintaining a Limited Liability Company (LLC) or a sole proprietorship. Whether you're a starting entrepreneur or an established business owner, ensuring the legal protection of your business and personal assets is import aspect of running a successful business.

Why Choose Wilson Legal Group?

Our team of experienced business attorneys specializes in LCC and Sole Proprietorships formation, providing tailored advice and solutions for LLCs and sole proprietorships. We take the time to understand your unique business assets and how to protect those assets. Our personalized approach and client communications ensures that you receive the most relevant and effective legal advice on you LLC and Sole Proprietorship.

Wilson Whitaker Rynell assists clients in Dallas, Houston, Austin, and the rest of Texas in helping protect the assets of sole proprietorships and limited liability companies. We have successfully helped clients in Plano, Frisco, Addison, Richardson, Fort Worth, Irving, Carrollton, Taylor, Dallas County, Denton County, Collin County.

Contact Us or Call 972-248-8080 for a Free Consultation!

Have an idea for a blog? Click and request a blog and we will let you know when we post it!